5 Strategies for Investing in Yourself

Sep 12, 2022

As a pastor, you invest in the lives of other people every day. But how much are you investing in yourself? We’ll talk about it in today’s episode of the More Than a Pastor Show. Let’s get started!

Hello my friend! Welcome to the More Than a Pastor Show. I’m your host, Rich Avery. This is where we help pastors leverage your ministry know-how into sustainable income outside of the church, through a business or side hustle that’s right for you. So you can serve God and provide for your family, no matter what.

Links for Today's Show

- Join our private Facebook community: https://www.morethanapastor.com/facebook

- Get the Free PDF: How to Know if Starting a Business is Right for You

- Read My Last Post: 4 Ways to Differentiate Yourself From the Competition

You might have heard that I'm trying to post a new episode every day in the month of September. It's a personal challenge I made with myself to double the number of episodes for the show...and get over the 50 episode mark.

Have you ever had a financial investment go bad on you?

Most of my investing experience has been with mutual funds…and real estate. But just over 20 years ago, I decided to purchase stock in one particular company.

I had heard experts say you should invest in companies you know…and in products that you use.

And there was one particular company that had a product that I was enamored with at the time. It was a tech product that had revolutionized the way millions of Americans worked.

No longer did you have to manage your calendar, contacts, and projects with a paper-based FiloFax, Franklin Covey Planner, or DayTimer.

No, in 1996 a product came out that put all of that information in the palm of your hand. It was called…The Palm Pilot.

The Palm Pilot was a hand-held computer organizer, which popularly became known as a personal digital assistant, or PDA. For you youngsters who might not be familiar…the Palm came before the iPhone, and was kinda like the iPhone. Without the phone. Or any apps. But what it did do was keep you organized by managing your calendar, your contacts, and your notes.

The first time I saw a Palm Pilot - owned by one of my co-workers - I was immediately hooked and HAD to buy one. And over maybe 8-9 years or so I owned several different Palm PDAs and used them regularly until I got my first iPhone.

On March 2, 2000, Palm issued its initial public offering on the NASDAQ Exchange. At the time, Palm was the world’s largest producer of handheld organizers, owning 68% of the U.S. market.

The stock was originally priced at $38 per share, but when trading began, the stock opened at $145 and soared as high as $165 during the first day of trading. But by the time the market closed, the stock dropped to $96.06, which was still more than twice its original offering price.

This price gave Palm a market value of $53 billion - almost twice that of its parent company, tech giant 3COM. But not only that…Palm’s market value exceeded that of bellwether companies in that era, including Ford Motors, General Motors, Philip Morris, and Chevron, and McDonalds.

Unfortunately, that market valuation didn’t last, because within a year or so of its IPO, Palm’s stock was consistently trading around only $5-6 per share.

And that’s when I thought it would be a great idea to buy some stock in Palm! Sometime in late 2001 I think.

Because after all, it was an innovative company I knew with a product I used and adored. And I figured the price was so low right now that it was a great value. And it surely couldn’t go any lower.

Oh, but I was wrong.

Because by October of 2002, the stock was worth only 65 cents a share.

And the company was looking to do a 1 for 20 reverse stock split, to try to increase the value of the stock. Which meant that for every 20 shares you had (worth 65 cents each), the company would trade those with you for 1 new share (worth 20 x 65 cents which is $13 each).

Thankfully, I hadn’t invested much money in Palm. I think I spent $50-60 to buy 10 shares, just as a low-cost probe to learn more about individual stock investing.

But after the 1 for 20 reverse split, I now owned zero shares of Palm stock. And my experiment was over.

And that’s when I discovered that investing in individual stocks of companies I know with great products I like aren’t always great investments.

Have you ever been there…with an investment that just didn’t pay off the way you had hoped?

Yeah, it’s not such a great feeling, is it, to lose money that you had thought would grow.

From time to time I follow Warren Buffett, probably the world’s most famous investor, and one of America’s wealthiest people, to see what his company, Berkshire Hathaway, is investing in, and why. I enjoy reading how Buffett thinks, and how he looks for undervalued companies that he knows he could buy and help them maximize their potential.

I guess he knows what he’s doing. He’s led his company, through acquisitions and investments, to exponential growth - many years earning a 15-20% return on investment.

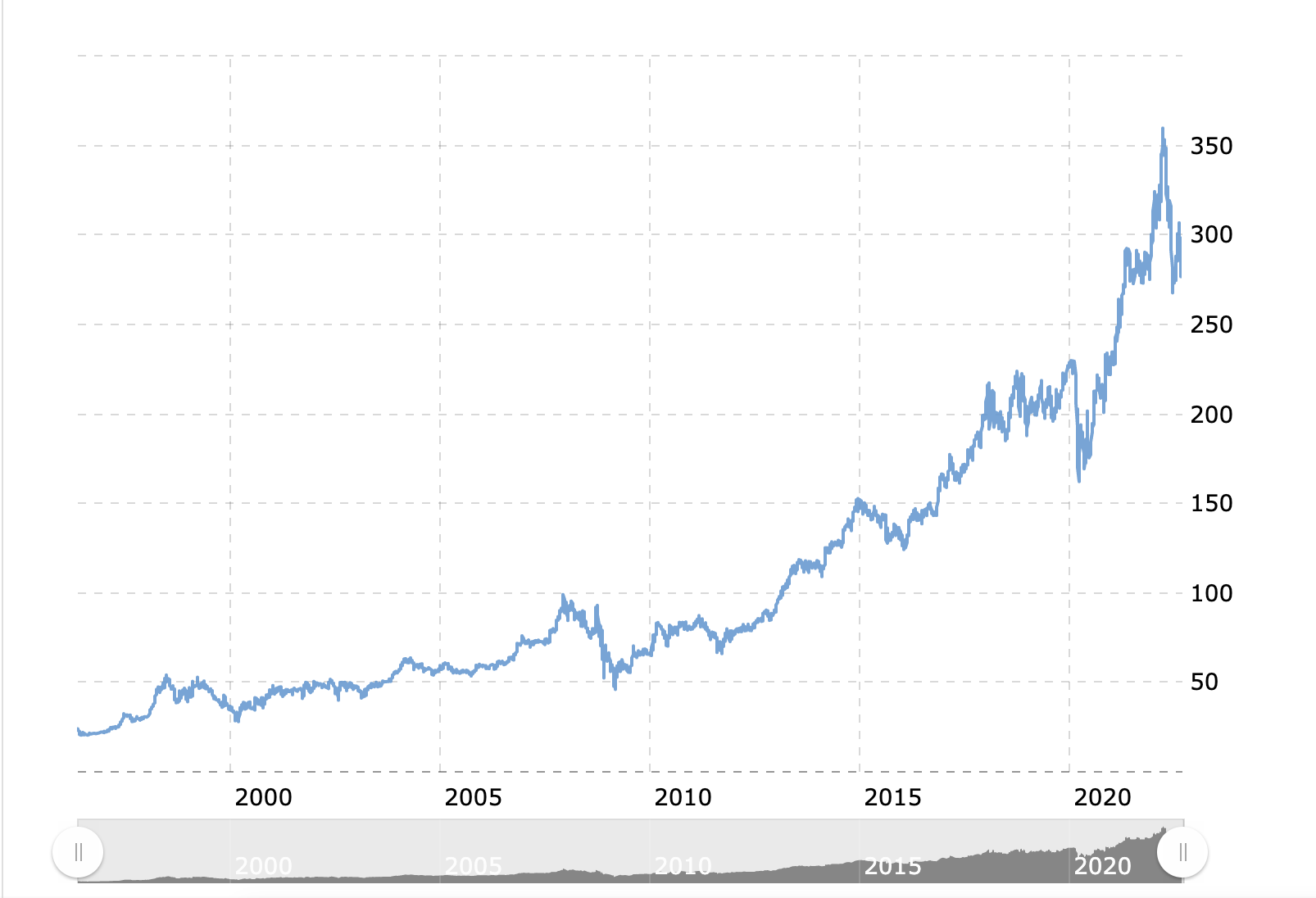

In fact, I did a little research, and discovered that if I had invested $50 in one share of Berkshire Hathaway stock back in 2001 instead of buying 10 shares of Palm stock, that one share would be worth $310 today!

Now that would have been a great investment!

So despite his success as a financial investor, when asked to share his investment advice, Buffett will often answer that the most important investment you can make is not a financial one.

During a Q&A session at Berkshire Hathaway’s annual meeting in 2008, Buffett said:

“The most important investment you can make is in yourself. Very few people get anything like their potential horsepower translated into the actual horsepower of their output in life. Potential exceeds realization for many people. The best asset is your own self. You can become to an enormous degree the person you want to be.”

In an interview with Inc. magazine, Buffett said, “Anything you invest in yourself, you get back tenfold...Investing in yourself is an investment you can’t beat.” Because unlike my Palm stock, it can’t be lost, taken away, taxed, or even eaten up by inflation.

3 Ways Pastors Can Invest in Themselves

So, what are the best strategies for pastors to invest in ourselves? I’d like to suggest we begin by looking for ways to invest in three specific areas:

- Our spiritual growth

- Our personal growth

- Our income growth

I’m already presuming that you know what it looks like to invest in your spiritual growth, through books, podcasts, conferences, retreats, spiritual directors, etc.

I’d like to focus on the other two: what does it look like to invest in our personal growth and income growth?

5 Strategies for Making an Investment in Yourself

Here are 5 strategies for investing in yourself:

1. Creating a personal development plan

A good one helps you define your preferred future (your dream life), clarifies your life’s purpose, evaluates your current reality in the basic areas of life (financial, family, career, health, spiritual, etc.), reveals your personal values for each life area (the beliefs that are important to you), sets well-defined goals, and creates a specific plan of action.

2. Investing in personal coaching

I believe every pastor needs a coach. A personal coach will help you see and create the future you were made for, and help you overcome the forces of delay, doubt, and distraction which work hard to keep you tethered to the status quo.

3. Be a life-long learner

Being a life-long learner is perhaps easier than ever before, because of the increased access to information that we have today. But because there's so much information out there, we're also more distracted than ever before. Some of the most accessible and affordable ways to continue to learn and grow is through:

- Books

- Podcasts

- Conferences

But don’t just learn…apply what you’ve learned. Take action!

4. Creating new streams of income through your own business or side hustle

It's never been easier for pastors to grow their income through their own business or side hustle. If you're wondering if you've got what it takes to be successful as an entrepreneur, check out my free guide, How to Know if Starting Your Own Business is Right for You.

5. Surrounding yourself with people who will help us achieve our goals and dreams

Experts say we’re the average of the 5 people we spend the most time with. So be sure you're spending more time with people you can learn from, and those who inspire you to get better every day.

Making a 3-5% Investment in Yourself

As shared previously, there are many free and low-cost ways to invest in yourself. But there comes a point for many of us where we need to make a financial investment in a coach who can help us get to the next level

Personal development experts like Brian Tracy and Dan Miller suggest that you start by investing 3 percent of your income back into yourself. And eventually grow it to 5 percent over time.

So if your income is $50,000 per year, start by investing $1,500 into your own spiritual, personal, and income growth.

Personally, I’m a firm believer in personal growth, and have invested more than 5% in my own growth, through books, events, membership communities, personal coaching, and spiritual direction.

These things are having a big impact on the trajectory of my life, helping me take action on my most important goals and dreams.

It’s also one of the reasons why I’ve launched More Than a Pastor - to help other pastors get unstuck and moving forward to creating the life, impact, and income they were made for.

If you’re not sure what personal growth or income growth should look like for you, let’s have you apply for one of my free 30-minute clarity calls, where I can help you figure out where you’re at today, where you want to go, and what’s your next best step. Apply today at morethanapastor.com/coaching.

What do you think about these five strategies for investing in yourself? Agree or disagree? Have other ideas? Please share your feedback in our More Than a Pastor community on Facebook at morethanapastor.com/facebook.

Let's Stay in Touch!

Sign up to receive free tips and exclusive offers to help you grow your income and build financial security.

We promise not to share your email with anyone or send you any spam!